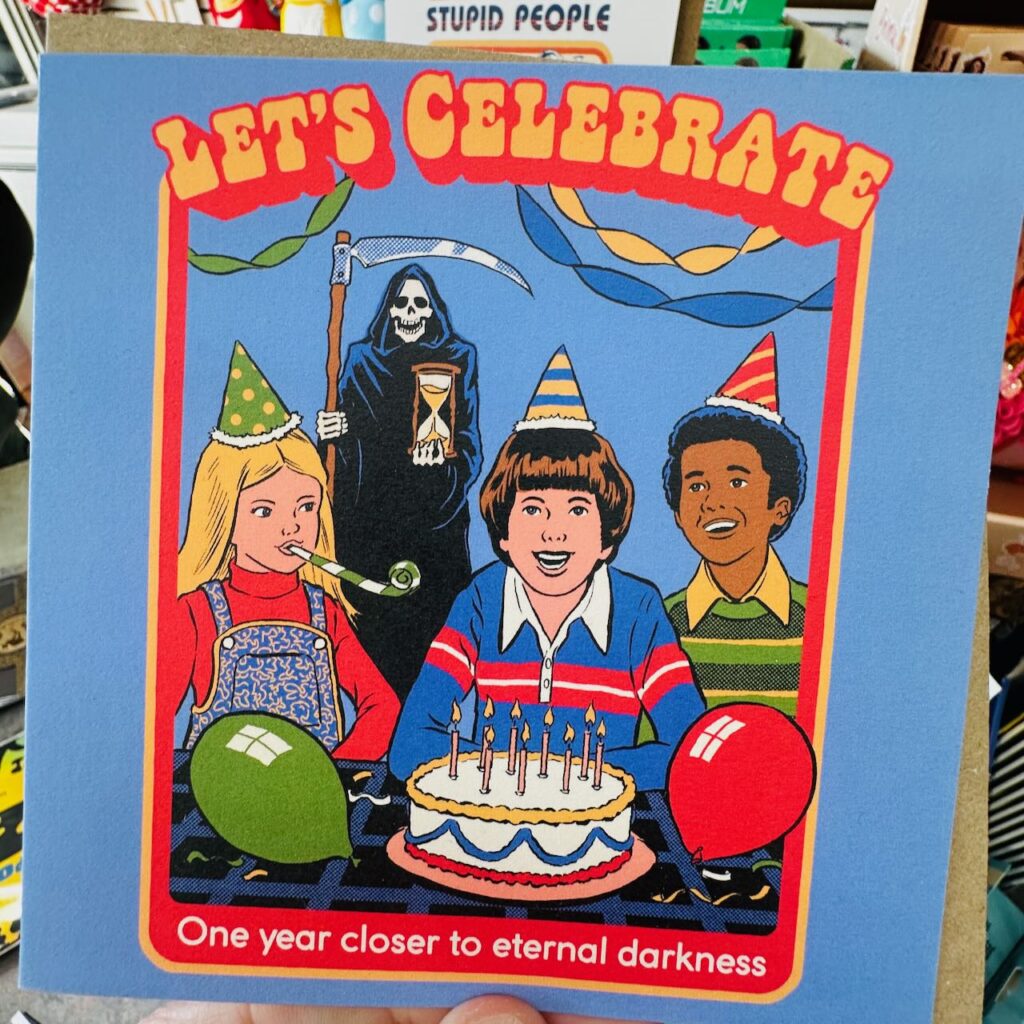

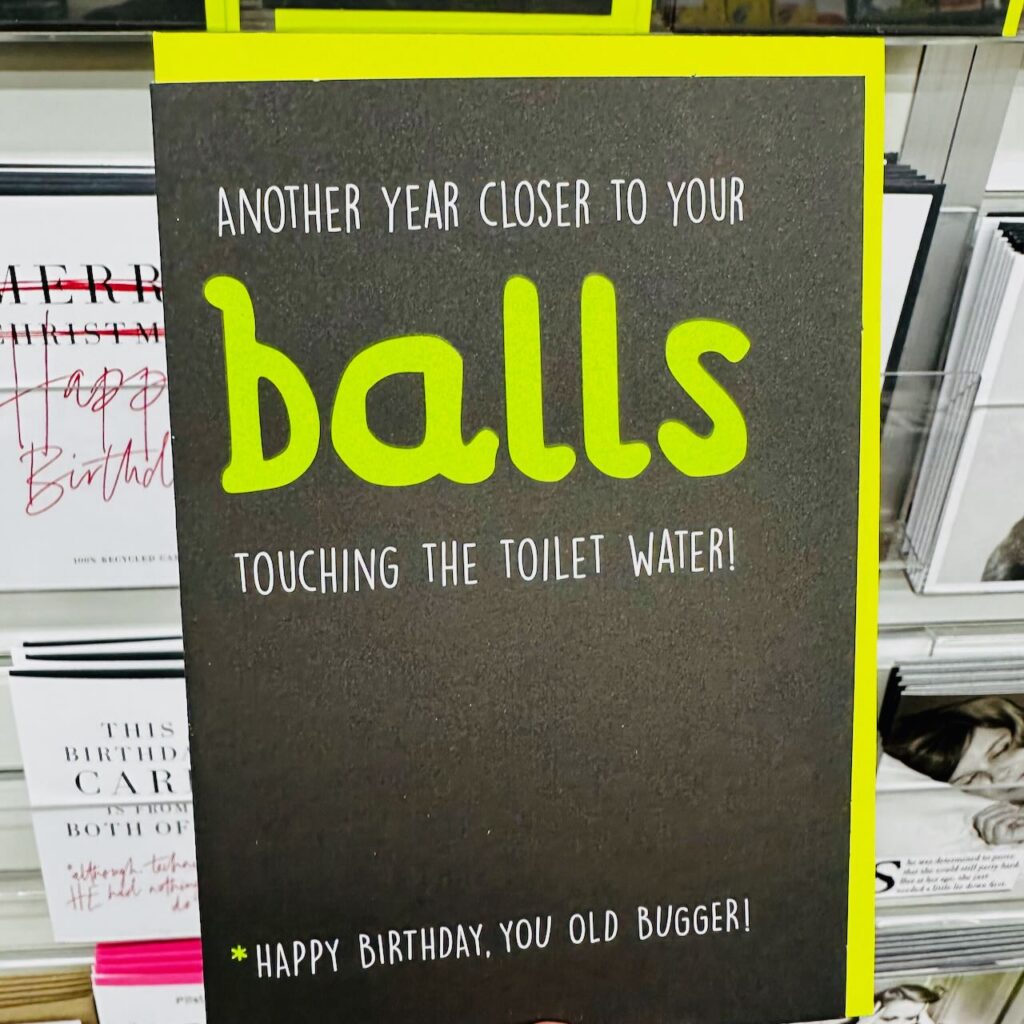

Cards they will cherish for years

Cards they will cherish for years

Cards they will cherish for years

We are helping AC/DC fans celebrate Bon Scott

newsXpress members are loving in-store business advice and assistance visits

Here’s what one newsXpress member said yesterday:

It was great to have you visit. Your visit just highlighted how beneficial it is to actually have somebody on the floor with you to discuss our thoughts/ plans and to receive your/their feedback and suggestions. Your visit has lit a flame and inspired us to do the card review and ultimately the removal of the magazine stand which is something that we had talked about previously but done nothing about.

newsXpress Mount Waverley

Advice for anyone considering buying a newsagency

Plenty of newsagency businesses are changing hands. We think that is in part because the channel had a good Covid. Retail businesses in our industry are looking sweet, and there’s some cracking opportunities out there.

A common question we get asked is, “What should I ask for when I’m looking to buy a newsagency?”

The question itself shows how green a prospective buyer is when it comes to buying a business. My first piece of advice is to get your head around the newsagency business of today, so you know what you’re getting into. And, I do mean today. The newsagency of today and into the future is not the agency focussed business of the past.

Here’s a list of data we suggest prospective newsagency buyers request from the vendor or their representative:

- The accountant’s P&L for the last two years. Not a spreadsheet that’s been created for the purpose. You need the real P&L.

- A list of add-backs used to calculate the profit figure on which the asking price is based.

- Tax returns for the same two years. While not always appropriate given business structures, they can be used to cross-check the accountant’s P&L.

- Sales data reports from the POS software for the last two years. This is the key data to verify the income claim.

- Sales data reports from the lottery terminal to verify the income claim.

- BAS forms to confirm the data in the P&L.

- A list of all inventory in the business, including the purchase price and date last sold for each item. And copies of invoices that you can randomly select to verify.

- A copy of the shop lease.

- A copy of any leases that the vendor expects you to take on board.

- A list of all forward orders placed on behalf of the business.

- A list of all employees, including their name, hourly rate, nature of employment, start date, accrued leave, and accrued long service leave.

This is all basic information that any buyer should have access to in order to assess a business. A business for sale for which this information is not readily available is not, itself, ready for sale.

Once you have the information, analyse it yourself. You should not outsource your decision as to whether a business is a good business to buy or not.

newsXpress is making things happen for newsagents in 2024

At the start of 2024 we set this year’s theme as MAKING THINGS HAPPEN.

It was a commitment to action, growth, success and enjoyment for newsXpress members.

Mid way through this year we are seeing terrific results.

We have helped members attract new shoppers with several exclusive new product ranges.

We have newsXpress members recording double-digit card sales growth because of our exclusive store specific card performance data project.

We have helped stores recalibrate their commitment to magazines to make this low margin category work, freeing high value space for better margin product.

Our retail insights trip to Berlin and London was a terrific success with excellent in-store initiatives flowing as a result.

This is what MAKING THINGS HAPPEN is about.

Nothing we pitch is mandatory. We are not a franchise.

We’d love to help if you are keen for it.

Cards to love

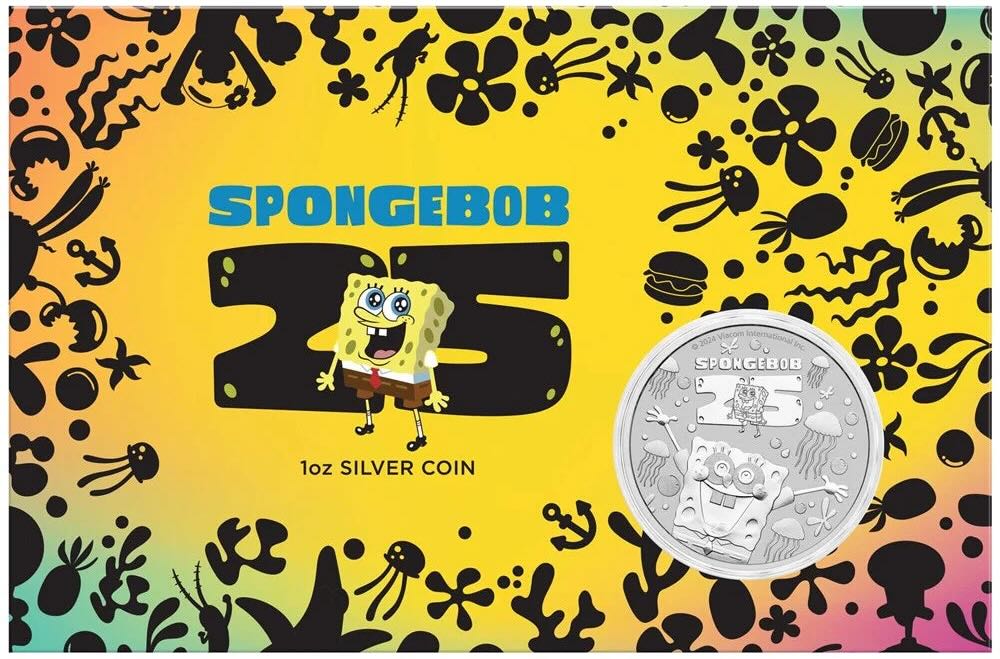

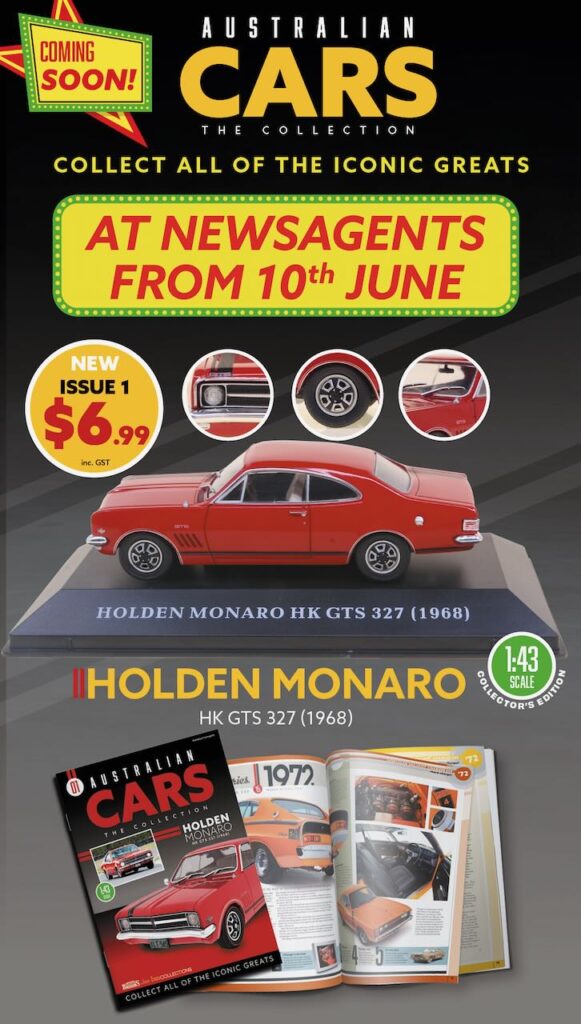

SpongeBob 25th anniversary coin out now

newsXpress helps newsagents have a wonderful 2024 and beyond

At the start of 2024 we set this year’s theme as MAKING THINGS HAPPEN.

It was a commitment to action, growth, success and enjoyment for newsXpress members.

Mid way through this year we are seeing terrific results.

We have helped members attract new shoppers with several exclusive new product ranges.

We have newsXpress members recording double-digit card sales growth because of our exclusive store specific card performance data project.

We have helped stores recalibrate their commitment to magazines to make this low margin category work, freeing high value space for better margin product.

Our retail insights trip to Berlin and London was a terrific success with excellent in-store initiatives flowing as a result.

This is what MAKING THINGS HAPPEN is about.

Nothing we pitch is mandatory. We are not a franchise.

We’d love to help if you are keen for it.

A Jellycat rainbow is a perfect gift

Jellycat rainbow.